Articles

You’ll must get a solution on a single itinerary and you may book at the same time (with your card) to use the brand new Partner Fare. An excellent indication-right up incentive is just one of the most significant benefits out of beginning a great the newest mastercard. And, sign-upwards added bonus offers defense a standard directory of finances, advantages versions, and you can timelines. Record less than makes it possible to find the best welcome give to maximize the investing and ensure you do not miss out on a great deal. Yes, you can generate numerous handmade cards at the same time so you can secure numerous indication-right up bonuses, however it could possibly get trust this cards you’lso are provided.

An informed perks handmade cards to have 2025

SoFi’s Automatic teller machine regulations are at https://wjpartners.com.au/riverbelle-casino/ the mercy of change during the the discretion at the any time.six. Having said that, take some time evaluate SoFi Checking and you will Deals that have examining accounts and high-produce savings accounts, and you will contrast cost or any other provides to find the right complement for your requirements. SoFi Checking and you may Offers isn't a high-produce checking account, nonetheless it now offers a higher annual fee produce (APY) versus majority of examining accounts—and also have of a lot offers accounts on the market. Nations Lender is just one of the country’s prominent full-solution financial organization, along with step one,200 twigs across the Midwest as well as the South, and 100 twigs inside Tx. Like other financial institutions, Countries continuously offers dollars incentives to help you bring in new clients to open up a merchant account.

M&T MyChoice Superior Checking account

This is an excellent offer and certainly one of an informed traveling credit cards. It’s below the new 100,000 acceptance bonus which had been offered 2 yrs before, however, greater than people 40,one hundred thousand offer. The last greeting added bonus provided just 60,100 extra items, now, you’ll discovered an additional $three hundred credit for the purchases made due to Pursue Travel to your exact same minimal purchase requirements. If you're looking to keep for the food shopping, now is a good time to take on applying for the new Blue Cash Preferred Credit of Western Show. Amex improved the brand new acceptance added bonus so you can $3 hundred, that is $50 over common, and you will added an excellent $0 basic yearly fee for one 12 months, next $95 (come across prices and you will charge).

As the greatest money back credit cards may sound reduced fun at first glance, they're able to nevertheless provide lots of well worth in order to cardholders. Money back cards will save you efforts thanks to its effortless redemption procedure. You claimed’t have to worry about navigating more information on tricky laws only to have the ability to accessibility their rewards. To help you get your cash right back, all you’ll have to do try request the shipment setting of preference, if or not one to be through a statement borrowing, take a look at otherwise lead deposit for the checking account.

- Explain the method that you pay and also have paid off which have founded-within the credit greeting, and you will several ways to accept payments and make dumps.

- The newest FanDuel app for the Fruit Ratings provides an excellent cuatro.9/5 score, while it has a good cuatro.7/5 to your Google Gamble Store.

- If you want a free nights prize and you may automated professional status, that it card might be a addition to your bag.

- The newest Southwestern Fast Rewards Performance Company Bank card football a valuable welcome extra well worth $step one,080, according to TPG's January 2025 valuations.

- There's a specific render you to definitely sets that it chase checking incentive which have a good chase offers added bonus.

- For many who only be the cause of the newest greeting added bonus, you can even be sorry for deciding on the cards later.

As well as, some money right back cards will let you receive cash back within the different options, for example for provide cards or shopping on the web. The new Chase Sapphire Preferred credit is dear, plus it’s obvious why. The new card packs a slap with the lowest annual fee, advanced extra classes, and several extremely worthwhile advantages. For individuals who’ve already been considering taking that it take a trip perks bank card, now is a final possible opportunity to make an application for that it restricted-go out increased give, that may stop on the November 14, 2024. Sign-upwards incentives leave you a lump sum of money back otherwise a huge number of issues or kilometers for individuals who purchase a good certain amount utilizing the cards in the a selected period of time, often the first few days immediately after opening the new account.

There's a targeted provide you to sets it chase examining bonus with a good pursue offers incentive. The mixture give pays $900 and you can includes so it $200 checking render, a good $3 hundred discounts render, and you will a good $400 bonus to possess doing each other. I might find you to combination just before carrying out either the fresh checking or deals in person.

Because they’re also intended to desire new customers, sign-upwards incentives be a little more ample than what cardholders tend to earn to own ongoing paying. Indicative-up extra will come while the a profit render, things, miles otherwise any kind of perks are given because of the cards. Since the Might discover Miles doesn’t have take a trip perks your’ll discover to your a premium card, it is a simple connect-the cards, generating step one.5 kilometers for each and every dollar on each pick.

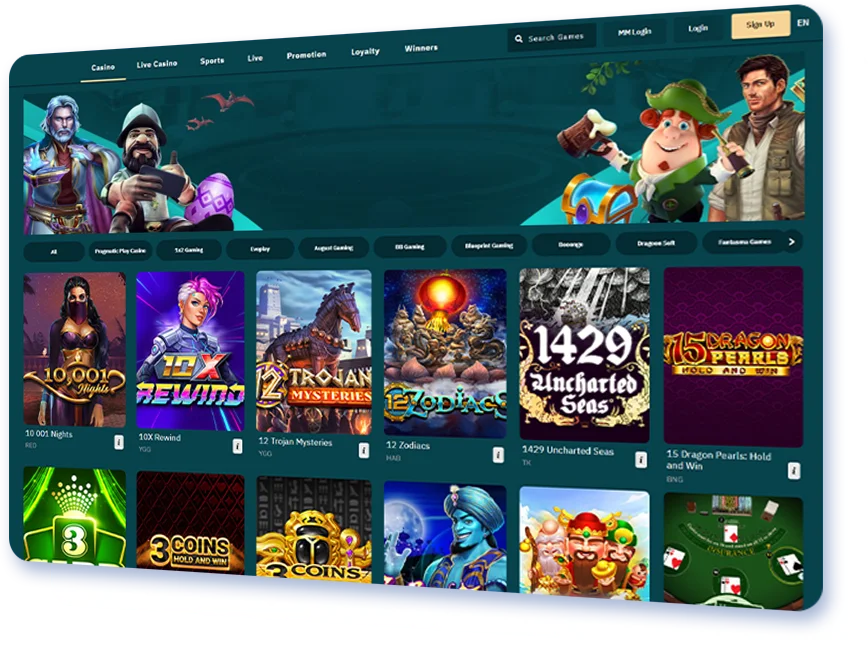

Slotastic $three hundred No deposit Extra

If you use which local casino extra, you can learn everything about the fresh offered games or any other gambling establishment has, instead impact the pressure of having to put major wagers right off of the bat. Comprehend all of our complete report on the financial institution from The united states Designed Dollars Perks credit card. FanDuel obtained’t discount bettors’ money otherwise weasel of using bettors’ fair winnings.

Specialist idea: You might couple it cards which have a find savings account

Go into your information below to discover the added bonus provide code to help you make available to a great banker during the account opening. We really do not costs any membership, solution or maintenance charges to have SoFi Examining and you will Deals. We do costs a transaction percentage so you can techniques for each outbound cord transfer. SoFi cannot fees an excellent feefor incoming cable transmits, however the delivering financial may charge a charge.

Better personal offer: $250 once $step 3,100 invested inside 6 months

Otherwise receive month-to-month head dumps, you can nevertheless earn the top offers rate by the deposit $5,100000 or even more every month. LifeGreen examining account has month-to-month costs between $8 otherwise $eleven so you can $18, but you can end the individuals fees because of the appointment month-to-month transaction standards. All the LifeGreen examining membership require an excellent $50 minimal deposit to open a merchant account. LifeGreen Offers is a simple savings account you to definitely earns limited focus centered on venue. An excellent Places savings account is required to open a good LifeGreen Savings membership.

The newest Southwestern Quick Advantages Overall performance Organization Charge card activities an important invited extra well worth $step one,080, considering TPG's January 2025 valuations. You will additionally rating a good $300 yearly travel borrowing from the bank, airport sofa accessibility and a host of almost every other higher rewards. The brand new $95 yearly commission could easily be counterbalance because of the totally free nights honor and you will solid earnings to your Marriott remains. So it credit is worth offered even though you usually do not remain at Marriott services seem to. Concurrently, the new cards provides an excellent earnings cost across the multiple kinds. That it credit may be worth considering for your needs even if you usually do not stay at Marriott features frequently.

Follow Us: Facebook Twitter Join our Mailing List: Mailing